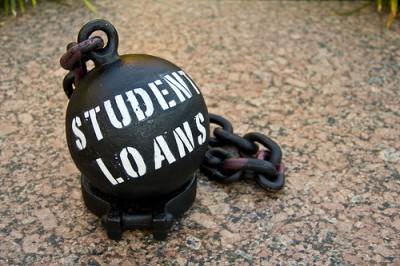

Are you scared to get admitted to a college because of the horrible student loan stats? Do you feel that you too will graduate with back-breaking debt after a few years? Well your concern is genuine since rising student loan debt has become our nation’s anxiety. Millions of students are jobless, cash-strapped and deep in debt. With little or no help from the job market, the burden of college debt can be really appalling. Moreover, too many myths regarding college debt can make the situation even worse.

Are you scared to get admitted to a college because of the horrible student loan stats? Do you feel that you too will graduate with back-breaking debt after a few years? Well your concern is genuine since rising student loan debt has become our nation’s anxiety. Millions of students are jobless, cash-strapped and deep in debt. With little or no help from the job market, the burden of college debt can be really appalling. Moreover, too many myths regarding college debt can make the situation even worse.

College debt is really a big concern nowadays. But this shouldn’t stop you from getting educated. All you need to do is get your facts right and plan your finances accordingly in order to avoid college debt.

Myths create misconceptions and that leads to confusions and it’s difficult to the make right decision when your mind is confused.

Here are the 6 college debt myths you need to debunk before pursuing higher studies:

1: There is no other option but to pay off student loans.

Oh! You must have heard this line many times from your friends and family – “You’ve to pay off student loans as soon as you can. If you don’t, then your wages will be garnished by the government.” I’m not saying this statement is false. You’re borrowing money to facilitate your career and morally, you should pay back your creditor.

However, this line omits a very important information, and that is, student loan forgiveness programs. Most borrowers don’t use this program to pay off student loan debt. These programs help you eradicate college debt for free. Almost 50% of borrowers are eligible for this program. You just need to look at the eligibility criteria and and take maximum advantage of this program.

2: You can easily forget your student loans until you’re a graduate.

No, you don’t have to. Would you like to end up with a huge amount of student loan debt after you graduate? Or, would you like to know how much you’ve borrowed and be prepared financially? Technically, it’s wiser to track your debts (both private and federal loans) from time to time. You can know how much you’ve accumulated on private student loans from your credit report. On the other hand, you can check out National Student Loan Data System to keep a tab on your federal loans. Calculate if you’ve received any grants or scholarship. You won’t have to pay a dime on them.

It’s best to pay whatever you can when you’re in college. If you can pay little extra, then that’s even better. This will only help you reduce your debt burden quickly.

3: Independent colleges are meant for wealthy families only.

This is a wrong concept. These colleges admit students belonging to different kinds of financial backgrounds – low-income, middle-income and high-income students. So, don’t strike out independent colleges just because you’re not a rich guy.

4: College debt doesn’t have an impact on your credit.

Just like credit cards, student loans can have a bad impact upon your credit score. Delinquent student loans will give a bad signal to creditors. You’ll face a big problem to qualify for a mortgage or any other loan in future. Besides, your credit score will drop as well.

5: You can’t afford a college without a huge loan.

College is expensive. Agreed. But this doesn’t mean you can’t afford a college without a loan. If you choose your major wisely and manage your finances properly, then it won’t be too difficult to pay for your college. Besides, if you live frugally, take advantage of grants, get a part-time job and use a budget, then it’ll be easy to complete your graduation without much hurdles.

6: Your easiest option is to shun college debt through bankruptcy.

That’s not true. You’ve to file an ‘undue hardship’ petition to discharge student loans through bankruptcy. You need to prove:

- You’re struggling to maintain a basic standard of living when making repayments

- You’re facing financial crunch and it’ll continue indefinitely

- You’ve made a genuine effort to pay off college debt

Honestly speaking, the smartest way to deal with college debt is to understand it’s various aspects minutely. College students need to understand the basic difference between myth and reality if they’re serious about paying off loans.

Contributed by Symon Roger

photo credit: thisisbossi via photopin cc