There’s no getting around it, college can be a huge expense.

With tuition costs at the highest they’ve ever been, it pays to do everything in your power to save money before, during, and after college to help lighten the financial burden. With so many different options for schools, loans, grants, and more – it pays to educate yourself on the student loan process.

Once you’ve learned a little more about what you’re facing, you can choose the most beneficial route for your education adventure.

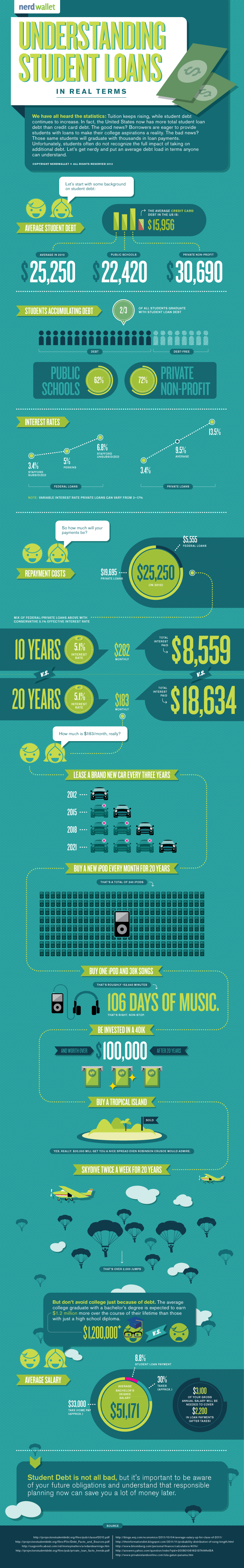

Here’s some information on the average student loan borrower:

The first thing to know is don’t be intimidated!

With Bachelor’s Degree holders earning roughly twice the lifetime earnings of high school graduates it’s an investment that, for many, is well worth it.

To make things easier, there are a quite a few things that you can do to help save for college and make it easier to pay the resulting cost.

We’ve compiled a list of 5 easy tips to lessen your student loans.

They are:

Complete the Free Application for Federal Student Aid (FAFSA)

FAFSA awards over $150 billion in federal financial aid yearly. With that much money to go around, it’s the #1 resource to check to see if you qualify for financial help with college. It’s easy, it’s fast, and you can file electronically. If you’re preparing to go to college or even if you’re already in university, filing FAFSA can go a long way toward helping you pay for college.

Check for Grants and Scholarships

Ask your high school guidance counselor for information, talk to your college’s financial aid office, and do some scouting around yourself to see if there are any grants or scholarships that you qualify for. Ranging from under $100 to a full-ride, you never know what you’ll be able to find. Every penny helps, and you’ll be glad that you spent some time to help your future self out.

Check out this list of weird and wacky grants and scholarships, you never know what you may qualify for!

Work During High School and College

An obvious tip, working greatly offsets the cost of going to college. If you’re still in high school, save all that you can during the four years that your expenses are low and use those earnings to help out with future tuition, room and board, textbooks, etc.

If you’re in college you can work during the school year (if you have enough time) and especially during the summers. Most students work full time during the summer months to stack up as much cash as possible for the next school year. Again, every penny helps.

Pro Tip: If you’re at a major university, look into being a paid subject for psychology experiments. Trust us, that’s not as daunting as it sounds. Most experiments consist of answering simple questions and nothing more. At Indiana University, subjects are paid $10/hr. plus bonuses for being on time to your experiment and additional bonuses for performance during testing. From personal experience, I once walked out of a 3-hour session with $120. Not a bad alternative to heading back home for a nap between classes.

Buy Used Textbooks

New textbooks can run up to almost $200 per book, yikes. With that being said, it’s easy to find used books at the campus bookstore and even easier (and cheaper) to find them online. You can pay 1/10 of the cost that you would for a new textbook with a used one from Amazon; it just takes a little longer to receive them since you’re ordering them online.

Pro Tip: Check for textbooks online immediately after receiving your syllabus for each class. Most professors email syllabi out before the first day of class and that will provide you with ample time to purchase and receive your books from an online vendor.

Create a budget

Creating a budget is a simple, effective, and often overlooked way to save money and help you through your college years. By listing your allowable expenses, you’ll be able to see where you spend most of your money and see where you can cut corners to save that extra buck. If you save just $10 a week that’s $520 at the end of the year, which is more than a month of rent or the cost of a semester’s textbooks for the frugal student.

In addition to those 5 tips to lessen your student loans there are a number of easy, effective, and cost saving measures that you can take, like student loan forgiveness programs. Do some research and see what you can find.

Overall, college is a wonderful time. For most students it’s the first time that you’re on your own, away from home, and living in a new city. It’s a great time to meet new people, try new things, and learn about your interests. As previously stated, depending on your school of choice, things can get pricey – but they don’t have to be.

With these 5 easy tips to lessen your student loans, we hope that you’ve found at least 1 option that you didn’t previously know about. The extra cash you save can translate to big things down the road: a new car, down payment on a house, or even a trip around the world.

It’s never too early to start saving for your future, and you’ll thank yourself down the road for the actions that you take to help your future self today.

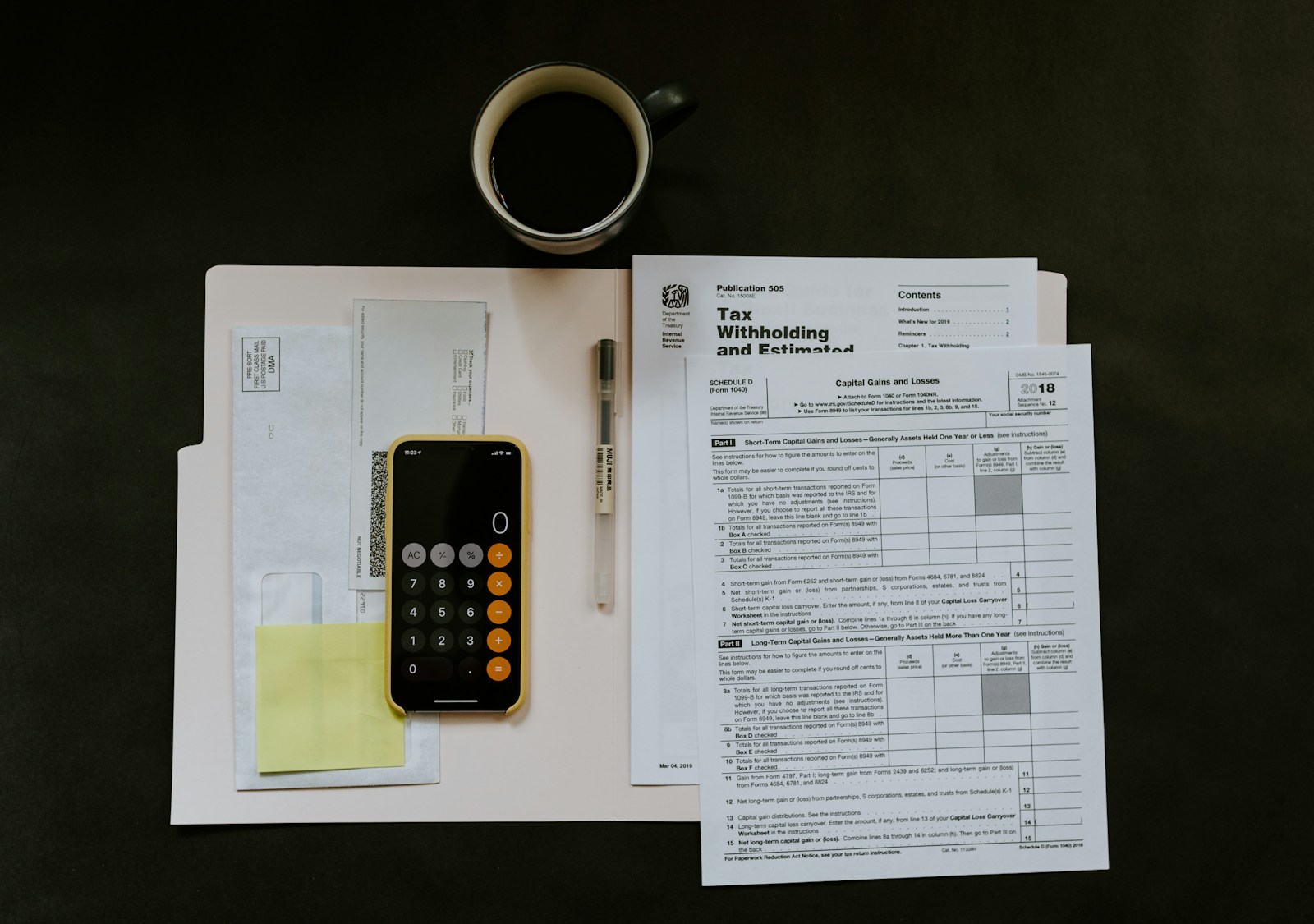

photo credit: 40+267 Weekend via photopin (license)

photo credit: Books (74/365) via photopin (license)

photo credit: Balancing The Account By Hand via photopin (license)